Boring, right? Why check your title?

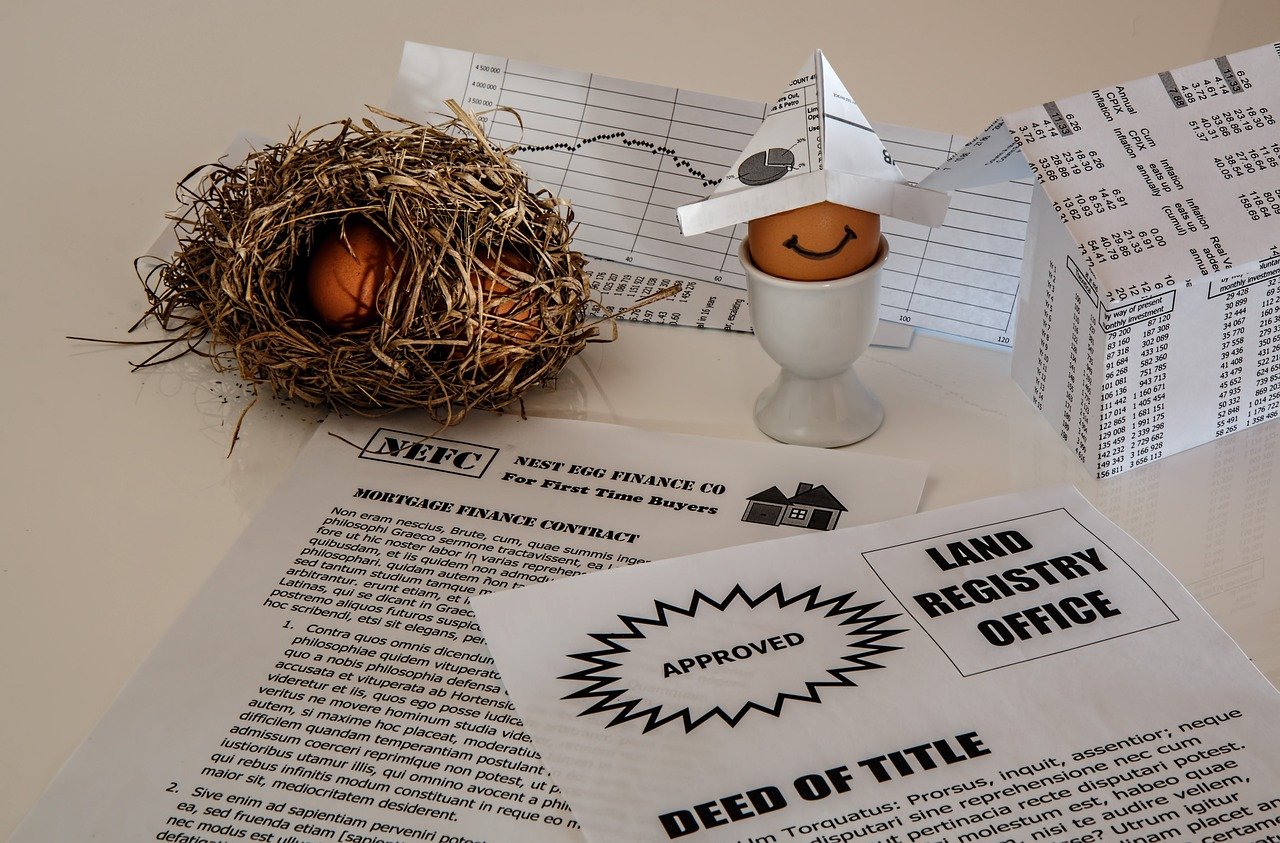

If you have a Trust, and if you’ve ever refinanced your home, there is a chance your lender asked/required you to take your home out of the Trust when your new loan is recorded in the public records.

Few people know they need to fill out and submit a form to the County Recorder to put their house back in the Trust when the refinance concludes. It’s easy to assume that since your lender required you to take your house out of the trust, they will put it back in the Trust for you, which simply isn’t the case.

A client of mine recently inherited the family home with her siblings after their parents passed. The parents had a trust. When someone wants to sell their home, the first thing I always do is order a title report. In this case, as you likely guessed, the house was taken out of the trust (in 2005) when the parents received a reverse mortgage and was never put back in.

The same thing happened with another client who recently reached out when they decided to relocate out of the area. They refinanced in 2017. The house was taken out of the trust and not put back in after the loan was recorded. You can correctly assume there are many more similar stories.

If you’d like to double-check that your home is properly deeded in your trust, please let me know.

It’s easy to check, and easy and inexpensive (the County filing fee is under $50) to put it back in if needed.